- Call us Today : +123 456 7890

- Email : email@eample.com

PM's own Detroit 7 Home Turn Key Rental Package With Meat on the Bone!

Seasoned investors can unlock gap funding and even secure up to 100% private financing. Surprising ROI (See the BRRRR Thrive spread sheet) and take over 7 units that have been recently renovated (see photos links on the tape) . Link to the full portfolio package—tape, photos, and comps included.

Outstanding Section-8 Multifamily Investment Opportunity *– High Occupancy, Turnkey, Section 8 Income

15041 Greenfield Rd, Detroit, MI:

25 units, all spacious one-bedroom apartments\- Acquire either complex for just $59,900 per door

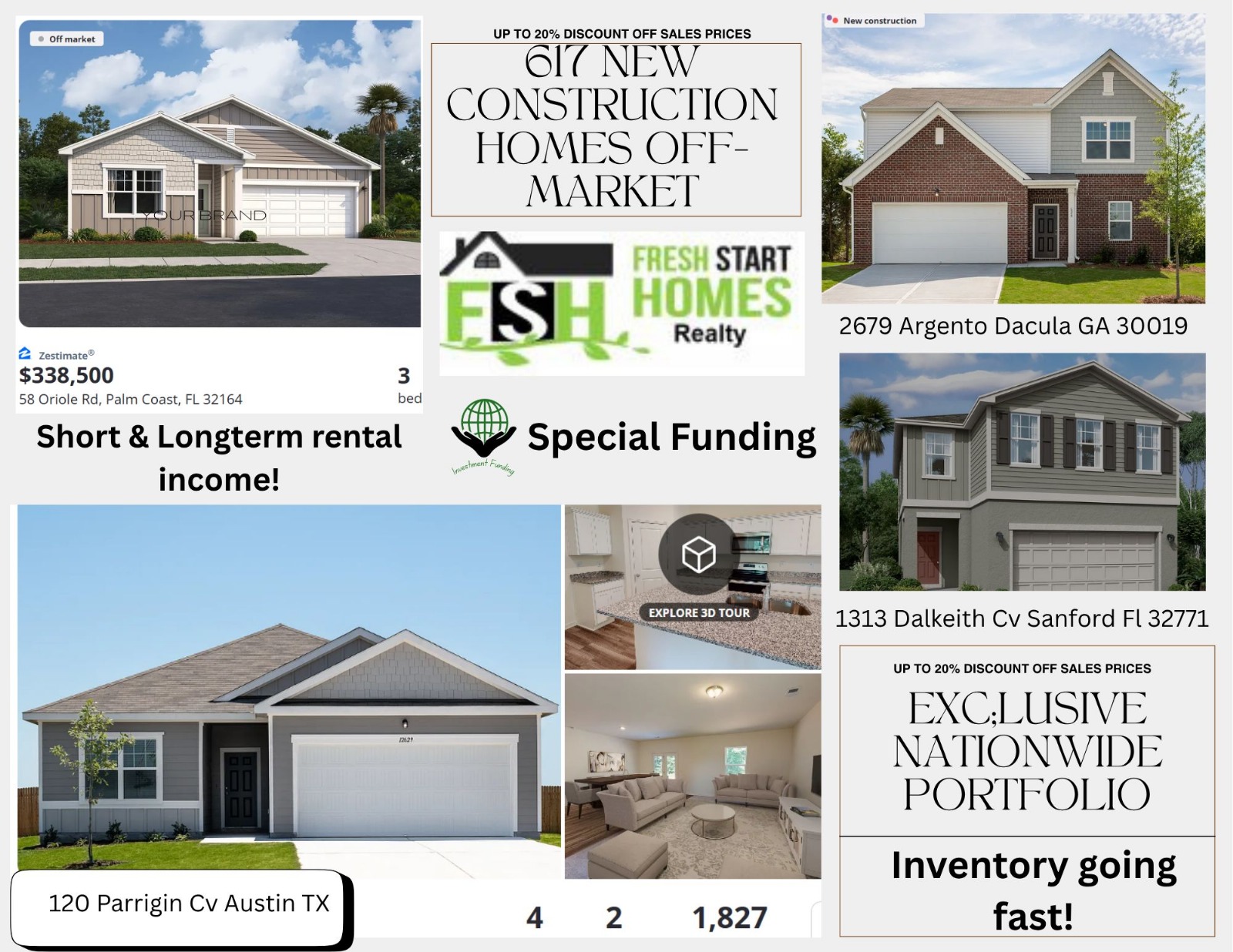

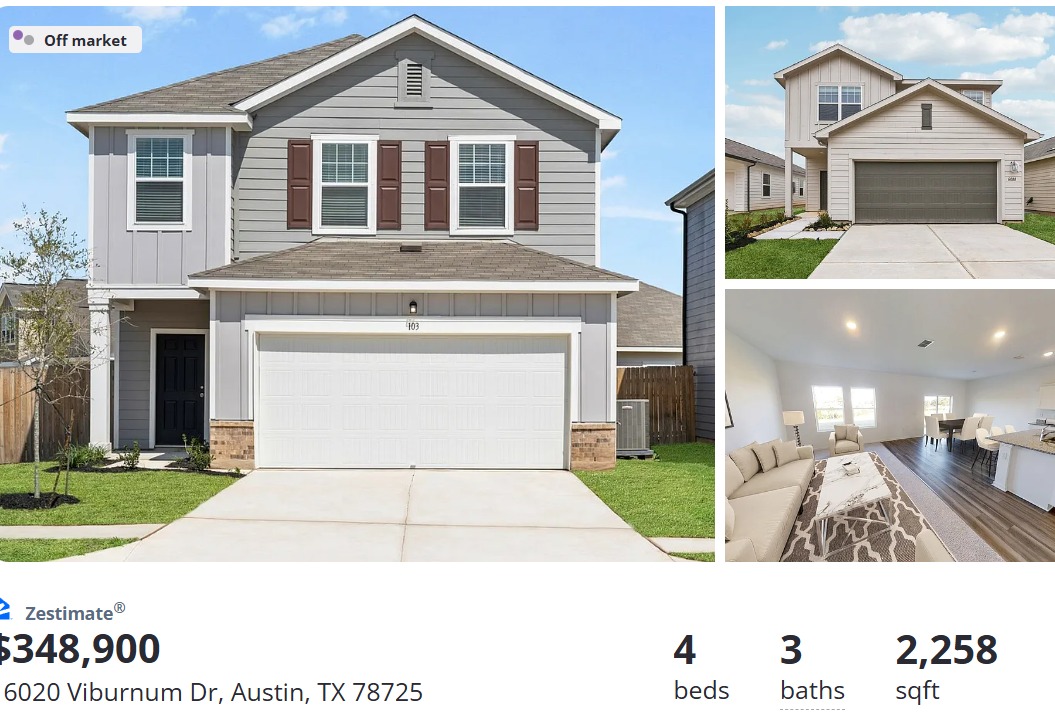

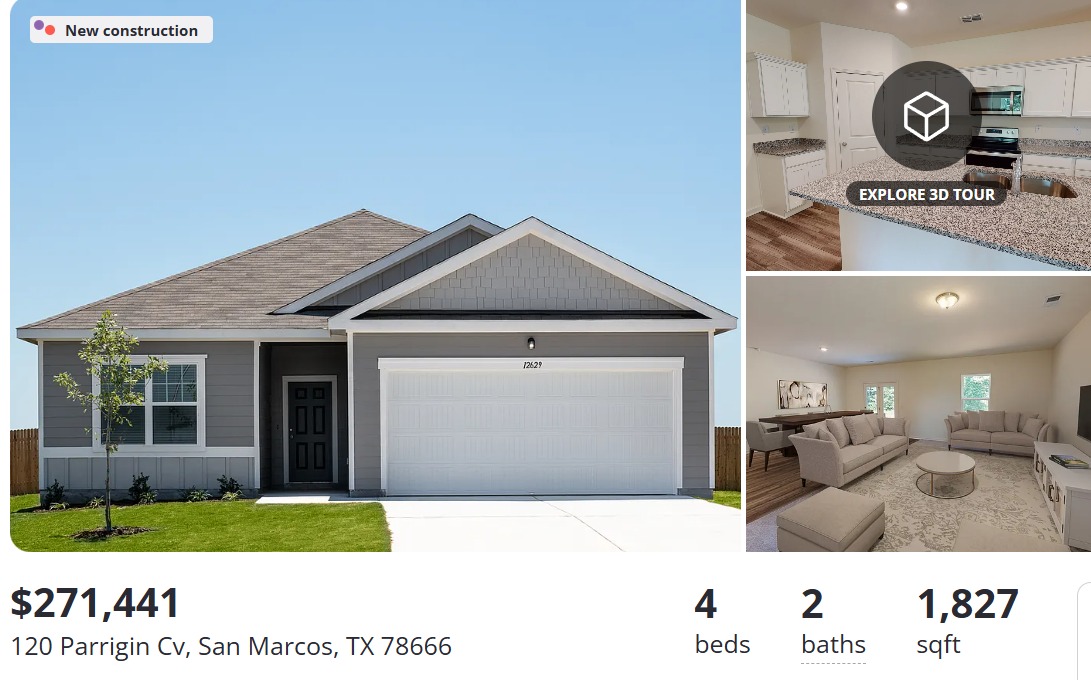

Exclusive Nationwide Portfolio – 617 New Construction Homes | Off-Market

We have an exclusive off-market nationwide portfolio that must be marketed only to external buyers and reputable representatives.

This is a rare opportunity offering 617 new construction homes across 7 states with strong financial performance and institutional-grade quality.

Exclusive Nationwide Portfolio – 617 New Construction Homes | Off-Market

We have an exclusive off-market nationwide portfolio that must be marketed only to external buyers and reputable representatives.

This is a rare opportunity offering 617 new construction homes across 7 states with strong financial performance and institutional-grade quality.

Outstanding Section-8 Multifamily Investment Opportunity *– High Occupancy, Turnkey, Section 8 Income

15041 Greenfield Rd, Detroit, MI:

25 units, all spacious one-bedroom apartments\- Acquire either complex for just $59,900 per door

all 3 complexes, 64 Units can be purchased together or separately.

2521 W. McNichols Detroit

Outstanding Section-8 Multifamily Investment Opportunity *– High Occupancy, Turnkey, Section 8 Income

Exclusive O -Market Multifamily Section 8 Portfolio – High Yield,

Flexible Terms, Prime Growth Market. 2524 W McNichols – 16 Units

Outstanding Section-8 Multifamily Investment Opportunity *– High Occupancy, Turnkey, Section 8 Income

15041 Greenfield Rd, Detroit, MI:

25 units, all spacious one-bedroom apartments\- Acquire either complex for just $59,900 per door

Outstanding Section-8 Multifamily Investment Opportunity *– High Occupancy, Turnkey, Section 8 Income

5805 Baylis, Detroit, MI:

23 units, comprised of 12 one-bedrooms, 9 two-bedrooms, one three-bedroom, and one four-bedroom apartment—ideal unit mix for diversifying tenant base

Or maximize your returns with a package deal at $55,000 per door

OFF Market 104 Unit Multi-Family

Flint I-475 & I-75 Area outside the City

the unit mix information

Read More

* Air Conditioning

* Cable Ready

* Dishwasher

* Disposal

* Washer/Dryer Hookup

* Heating

* Security System

* Kitchen

* Range

* Tub/Shower

* Walk-In Closets

* Carpet

* Dining Room

* Vinyl Flooring

* Window Coverings

SITE AMENITIES

* Controlled Access

* Fitness Center

* Property Manager on Site

* Storage Space

* Lounge

* Maintenance on site

* Sundeck

Outstanding Section-8 Multifamily Investment Opportunity *– High Occupancy, Turnkey, Section 8 Income

15041 Greenfield Rd, Detroit, MI:

25 units, all spacious one-bedroom apartments\- Acquire either complex for just $59,900 per door

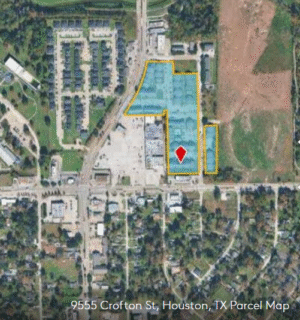

Houston’s Multi-Family Power Play: 297-Unit Crofton Place Offered Below Market at $20M — 7% Cap Rate & Strong Upside!

Read More

7 Mile & Lahser Detroit 96 Units $5,280,000

The properties include four buildings with a total of 96 apartment units, built on three parcels of land.

PM's own Detroit 7 Home Turn Key Rental Package With Meat on the Bone!

Seasoned investors can unlock gap funding and even secure up to 100% private financing. Surprising ROI (See the BRRRR Thrive spread sheet) and take over 7 units that have been recently renovated (see photos links on the tape) . Link to the full portfolio package—tape, photos, and comps included.

21516 Dequindre, Warren, MI ,Sales price $48,900,000 and 479 Units Prime Value

DETROIT, MICHIGAN – AREA CODES 48205 & 48228

23 Turnkey, Cash-Flowing Section 8 Single-Family Homes – ALL Under $2 Million!

Ready to supercharge your portfolio with properties that pay you from day one?

We’ve got 23 rental-ready Section 8 homes in two of Detroit’s most in-demand rental markets,

and you can cherry-pick the ones that fit your investment strategy.

Outstanding Section-8 Multifamily Investment Opportunity *– High Occupancy, Turnkey, Section 8 Income

15041 Greenfield Rd, Detroit, MI:

25 units, all spacious one-bedroom apartments\- Acquire either complex for just $59,900 per door

Off Market-Section 8-38 Units Midtown Detroit-Walk to Henry Ford Hospital $2,250,000 or best offer!

This duplex is located in the desirable Virginia Park area, presenting an excellent opportunity for significant growth. Nearby, Henry Ford Hospital is undergoing a $3 billion expansion. Similar expansions around three Chicago medical complexes in recent years have led to rent increases of more than double in properties within walking distance.

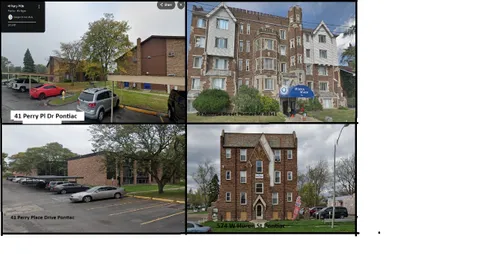

Pontiac 283 Multi-Family units Asking $25,000,000

Four locations in Oakland County, Michigan, offer affordable housing—a rarity in the area. The influx of jobs from companies like Amazon, Stellantis, General Motors, and Magna International has created high demand. These units need updates and professional property management to increase rental rates.

Nearly $8 million has already been strategically invested into extensive renovations, repositioning these assets for optimal performance and elevating rents to near-market rates. In Cincinnati, a city with robust tenant protections, every new tenant undergoes city certification—helping ensure compliance and tenant quality. Meanwhile, the process in Kansas City and St. Louis is streamlined for faster leasing and lower overhead. Link to photo on the right

97 Units SFR & Multi-Family Detroit & Down River properties

You control your investment strategy: Acquire a city-specific package or capitalize on the full portfolio for immediate scale and geographic diversification.

Take advantage of this rare opportunity to secure a turnkey, income-generating portfolio in ascending Midwest markets—transitioned from non-performing, fully upgraded, and primed for strong returns.

7 home package-$150,000 Door ARV's as much as $225,000 Door

Twenty-four turnkey single-family homes turn key rentals are available which includes homes in Warren, St. Clair Shores, Eastpointe, and Roseville. ARV averages $175,000 each. And A separate package of seven homes in St. Clair Shores is also available at $150,000 per home with ARV average $210,000.

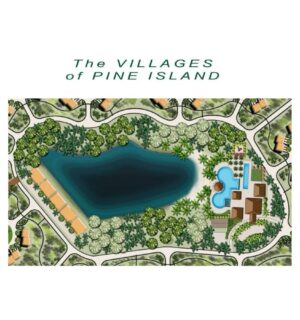

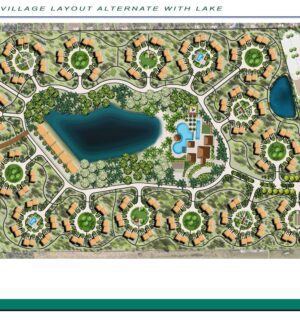

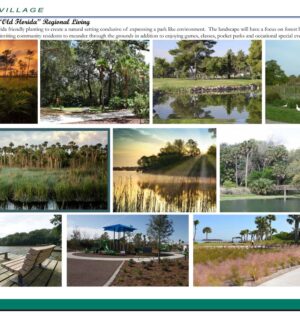

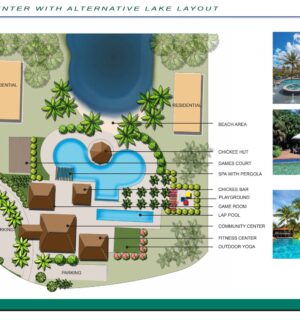

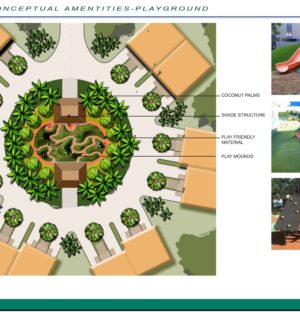

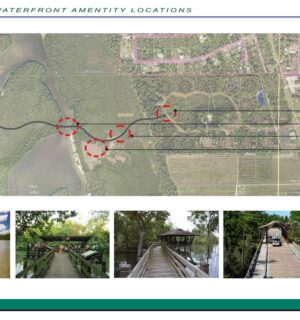

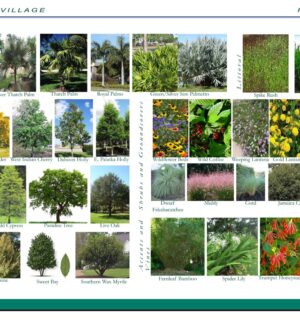

Florida Gulf Coast Investment Opportunity – Pine Island Villages $120,000 per building site

120-Unit Shovel-Ready Residential Development | Approved Plans & Environmental Clearances

HUGE PRICE DROP-$60,000!!!

Macomb 7 home package-7 Home Macomb rental package.$735,000

All tenants are currently on flexible month-to-month leases and paying well below market rents — creating an immediate value-add opportunity. upfront renovation costs.

Read More

With strategic rent adjustments, you can quickly unlock significant upside, whether by retaining the reliable existing tenants or bringing in new ones at market rates. A great value at $735,000! The property itself is in above-average condition, thanks to the care of the current owners, seasoned tradespeople who have kept it in excellent shape. This is a turnkey chance to boost cash flow and maximize returns without heavy

HUGE PRICE DROP $7,000 !!!

22008 Ridgeway St, SCS 48080 – Turnkey Cash Flow + Value-Add Potential!

Investors, here’s your chance to grab a high-demand rental in one of St. Clair Shores’ most sought-after neighborhoods — 9 Mile & Mack